Mark Kolta professionally registered with the SEC as an investment adviser in Miami Beach. He owned and supervised all operations of Kolta Group, LLC in New York for the reason that the creation of company wealth manages there for almost nine years. He spent more time as a Registered Representative with a capital benefit. Mark Kolta perception the Hacienda is a term that describes a council representing banks related to health, the leverage or debt, credit, capital market, cash, and investments.

Profit Planning is a systematic and formalized technique to determining the effect of management’s plans upon the company’s profitability. In order to undertake making plans for-profits, finance supervisor makes projections of outflows and inflows of the employer. The principal inflows of an enterprise are people, capital and materials and they’re typically value incurring factors. Managerial efficiency is a profit-seeking organization is commonly gauged in phrases of probability.

Profit planning is simply the development of your running plan for the approaching period. Your plan is summarized in the form of an income assertion that serves as your income and earnings objective and your budget for the cost.

An enterprise should plan profits by considering its talents and resources. Profit making plans lays a basis for the destiny income statement of the agency. This process starts off evolved with the forecasting of Les and estimating the desired degree of profit-taking in view of the market conditions.

Profit Planning Process:

Steps involved in the profit planning process:

1. Establishing profit dreams:

This implies that profit desires should be set in alignment with the strategic plans of the organisation.

Moreover, the profit dreams of an enterprise have to be sensible in nature primarily based on the competencies and assets of the organization.

2. Determining the expected income quantity:

Constitutes the most essential step inside the profit planning process. An employer desires to forecast its income volume so that it may acquire its income goals.

The income quantity can be anticipated by deliberating the marketplace and industry tendencies and performing aggressive analysis.

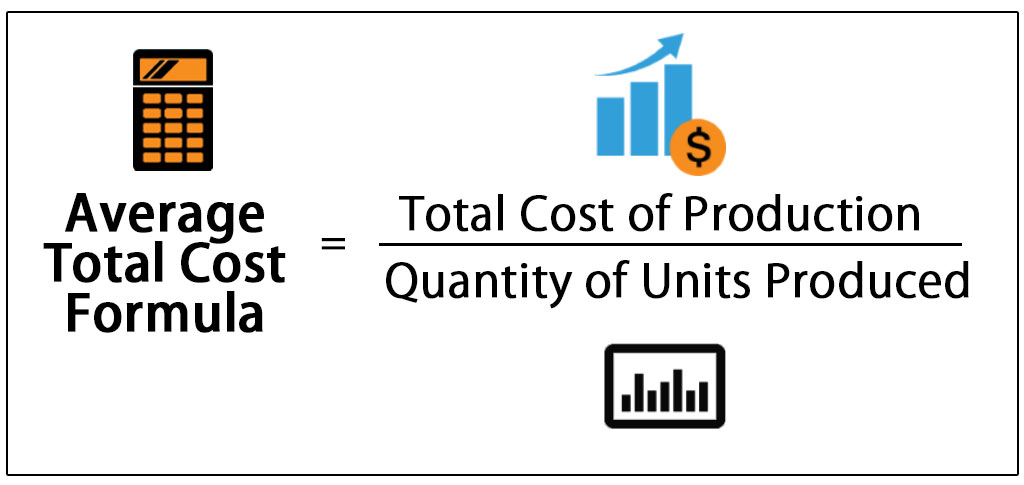

3. Estimating costs:

Requires that an agency desires to estimate its fees for the planned sales volume. Expenses may be determined from the past records.

If an agency is new, then the information of a similar organisation in the identical industry may be taken. The rate forecasts must be adjusted to the economic situations of the country.

4.Profit Analysis:

It facilitates in estimating the exact value of sales.

It is calculated as:

Estimated Profit = Projected Sales Income – Expected Expenses

After making plans profit successfully, an corporation needs to govern income.

Profit manage includes measuring the distance between the envisioned level and the real degree of earnings achieved by means of an agency. If there is any deviation, the necessary moves are taken by the organisation.